10. Pension Life

in Japan

@28/Dec/2005

RSS Eurasia Club/JICA SV in RSS Amman Jordan

[Purposes]

[Coordinator Office]

[Schedule]

[Materials]

[Top]

1. Abstract:

People of Japan in general, retire at their age of 60 from their carrier.

What will happen after that? Average longevity of our people is now over

80. There are roughly another 20 years of time flame to enjoy or suffer

their life. People always dream of pleasant life with well paid pension

life after retirement. Is this the dream to be come true? Unfortunately,

it is not the real case for most of the cases. One reason is that the pension

is paid only when a person become 65 years old on the current pension system.

There is a big time gap between the end of salary payment and start of

pension payment. People have to manage to produce the means of income to

compensate this five years time gap. Secondly, the amount of pension to

be paid decreasing each year. This is because of the rapid change of population

configuration in Japan. Number of elderly people is ever increasing, on

the other hand, number of junior people, who have to support the pension

of their elderly is ever decreasing. In very near future, only four working

people have to support one pensioner. Now the whole pension system is questioned

to be modified drastically or primarily, otherwise the system would automatically

be corrupted itself in real short time.

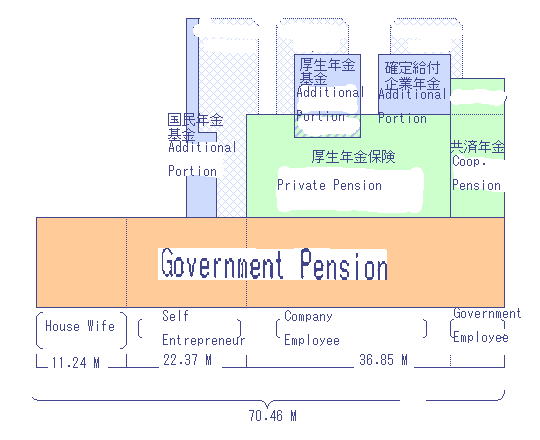

2. Current Pension System In Japan:

There are two major pension systems in Japan. One is government managed pension system for everyone of Japanese. The other is operated by private companies. Majority of working people in Japan receive two pensions together after they retire. Very roughly saying, after retirement, people can get half amount of money what they earn before they retired as pensions. This is probably enough to live in cost saving mode without having much funs. But living without having extra activities than just eating and sleeping, is not interesting at all and should be very boring. People soon find themselves in very bad mental conditions. It is obvious to have a little more money to keep the living as reasonably active and satisfactory.

There is another big problem in our current pension system. It is the time

when the payment of pension is started. People retire at 60 in most of

the cases, and payment of pension starts when he becomes 65 years old.

There is a big five years gap, during this time flame, people have no income

from anywhere.

Structure of current Pension system in Japan

People retire at their 60 in most cases in Japan

Pension payment starts at their 65.

There is big 5 years gap between the two

3. How They Compensate The Big Five Years Gap:

People have to find an income source in their 60 and 65 years old, to sustain and enjoy their life. Several measures can be considered. The most popular measure is to find a job that might be less skilled and much less paid than his previous job that he engaged before his retirement. People sometimes suffer to put himself under humiliated conditions. But there is no other way to secure his standard level of living except reconciling the situation. A few lucky person can live well without taking a job after retirement, instead having abundant inherited assets or having enough saving/assets he made during his carriers.

Elderly person often works in reduced payment between their 60 and 65 or beyond

4. Pension Life:

Pension life in Japan is getting more and more difficult in economically

for most salaried person. Most major problem is decreasing amount pension

they receive monthly, and increasing expenses for foods, medical cares

and others. Currently, people can receive about half the amount of their

salary they received before retirement. But, this ration could not be kept

for long, since age balance between young and old are changing rapidly.

Soon, only four working person have to support one pensioner. In such a

case, pension amount shall be much smaller than what they receive today.

Human being never satisfied with only bed and bread. We need something

more to enjoy the life. It means that we need some more money to spend

on something extra than basic costs. A considerable percentage of the pensioner

are currently taking minor job that helps him to afford little things in

order to feel happiness and satisfaction on their life.

5. Medical Cares for Elderly Persons:

In Japan, basically every citizen has blanketed by health insurance in

case of person get sick or injured. During their employment period, usually

the corporation insurance covers 70 % of their medical costs. The corporate

health insurance is run by the insurance premium paid by employees and

employers in fifty-fifty ratio.

After retirement, people would normally lose the right to benefit from this corporate health insurance. There are two options for the retirement person that they would be cared of their medical costs. One is to continue belongs in the corporate health insurance paying full portion of the insurance premium, in other words paying double as much amount that they were employed. This would be a rare case because people has almost no income or very little income after they retired and not able to afford paying double premium for the particular cooperate health insurance they belonged. The other option is the Government health care insurance. With certain procedures, elderly people after retirement and before reaching 70 years old, person can be beneficent of government health care insurance. This government health care insurance is run by local government basis. Therefore, people has to be taken care at local medical facilities where the person live in.

There is another government run health insurance for elder people beyond

70 years old. When people get reached 70, they are entitled to the beneficent

as special elderly health cares by run by the government. At the moment,

all medical costs are covered by the insurance, no personal payment is

required. There are controversial discussion among people that certain

amount of this medical costs shall also be born by the recipient. In near

future, these elderly people would have to bear 5 to 10 % of their medical

cost.

Typical example of a hospital reception

6. Care House for Elderly Persons:

Great many variety of care houses are available currently in Japan, from

very reasonable priced one to extremely luxurious level. Services vary

depend on the level of care required for the person to be living in the

house. In decades ago in Japan, elderly people were living with their family

having cares from their own family or relatives. But in these day, many

people are living in town far apart from their parents or relatives, therefore,

in many cases, when they became older and need cares, there is no choice

than moving to the care house affordable for them. This usually cost a

fortune. If you have no saving, assets or immovable, you might not be able

even to move to the care house.

Typical example of the costs and services of the care house for elderly

persons available in Japan is as below.

| No | Item | Description |

|---|---|---|

| 1 | First Payment | $ 5,000 to $ 3,500,000 |

| 2 | Monthly Payment | $ 1,500 to $ 3,500/person $ 2,500 to $ 5,500/couple |

| 3 | Floor Dimension | 15 m2 to 25 m2 for individual room 45 m2 to 55 m2 for 4 to 8 persons room |

| 4 | Meals | 3 times/day provided |

| 5 | Sanitary services | Sheets and pillow cover is cleaned regularly |

| 6 | Health cares | Usually a hospital located near to the care house is assigned to take cares of persons who live in the care house. Regular health check and spot cares are available. Basic care is usually included in the monthly payment. Additional cares are available on additional cost basis |

| 7 | Additional Cares | Depend on the necessity of the person, care services such as bathing, walk practices, feeding and etc. are available on additional cost basis. |

Outside View of Care House for Elderly Persons

| [Coordinator Office] [Purposes] [Schedule] [Materials] [Top] |

| [Back to Page Top] |